How Urgent is HVAC Repair?

In the United States, heating and cooling account for about 48% of energy use in a typical home, making it the largest energy expense for most households. When your HVAC system malfunctions, it can quickly become a pressing issue, especially during extreme weather conditions. Many homeowners find themselves searching for an “hvac repairman near me” when faced with a sudden breakdown. But how urgent is HVAC repair really, and when should you call in a professional?

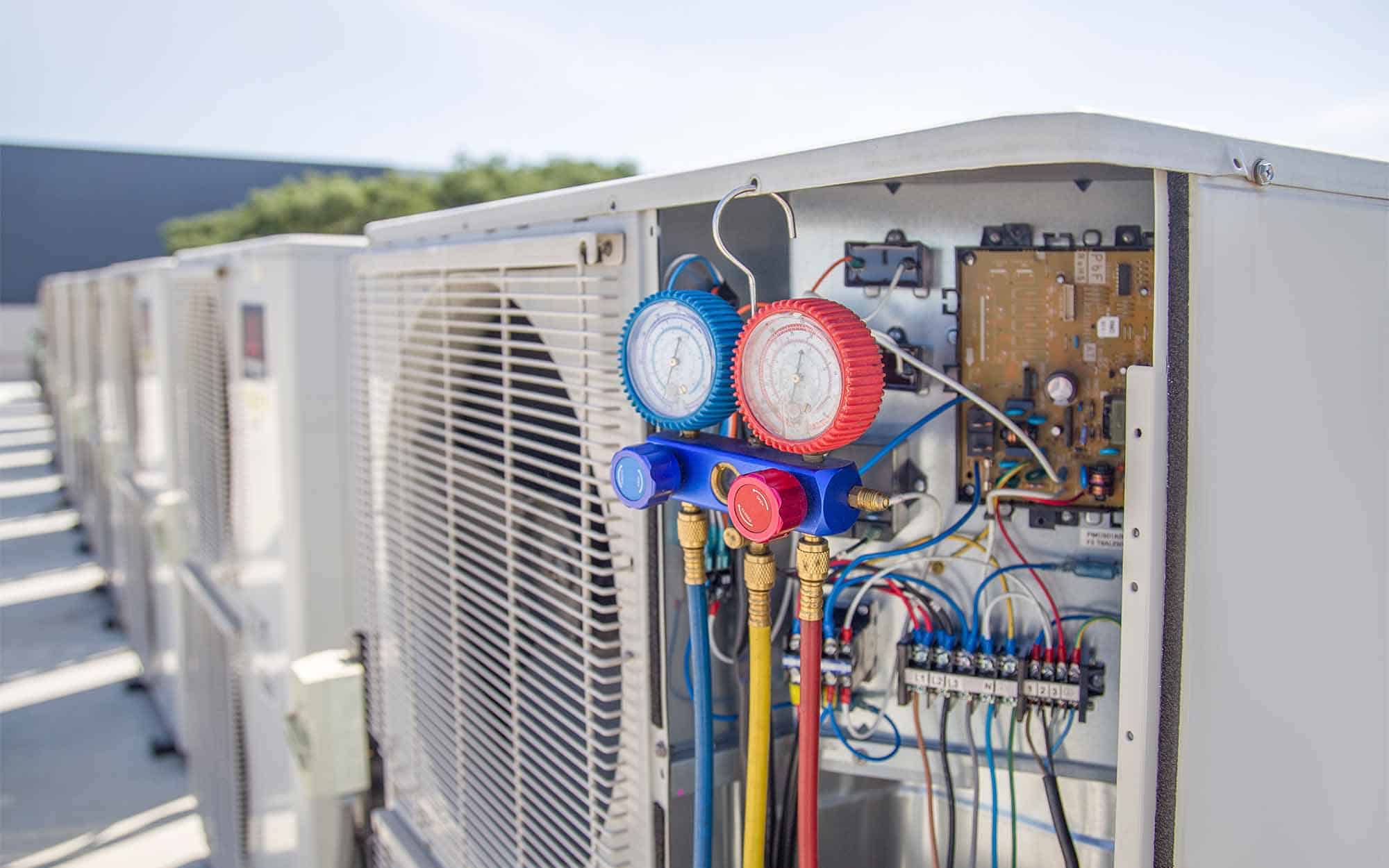

Understanding HVAC Systems and Common Issues

HVAC systems are complex networks of machinery that work together to maintain comfortable indoor temperatures. These systems include furnaces, air conditioners, heat pumps, ductwork, and thermostats. When one component fails, it can affect the entire system’s performance.

Types of HVAC Problems

HVAC issues can range from minor inconveniences to major emergencies. Some common problems include strange noises, weak airflow, uneven heating or cooling, and complete system failure. While some of these issues may seem tolerable in the short term, they can often indicate more serious underlying problems that require professional attention.

The Importance of Timely Repairs

Ignoring HVAC problems can lead to more extensive damage and higher repair costs down the line. Additionally, a malfunctioning system may consume more energy, leading to increased utility bills. In some cases, neglected HVAC issues can even pose safety risks, such as carbon monoxide leaks from faulty furnaces.

When HVAC Repair Becomes Urgent

Certain situations demand immediate attention from an HVAC professional. These emergencies can pose risks to your health, safety, or property if left unaddressed.

Complete System Failure

If your HVAC system stops working entirely, especially during extreme weather conditions, it’s considered an emergency. In hot summer months, this can lead to dangerous heat exposure, particularly for vulnerable individuals like the elderly or young children. Similarly, a heating system failure during winter can result in frozen pipes and potential water damage.

Unusual Odors or Sounds

Strange smells, such as burning odors or gas-like scents, can indicate serious problems that require immediate attention. Likewise, loud banging, screeching, or grinding noises from your HVAC unit should not be ignored, as they often signal mechanical issues that could worsen if not addressed promptly.

Water Leaks

Visible water leaks around your HVAC unit can lead to water damage and mold growth if not addressed quickly. These leaks may stem from condensation issues, blocked drain lines, or refrigerant leaks, all of which require professional diagnosis and repair.

Non-Emergency HVAC Issues

While some HVAC problems demand urgent attention, others can be scheduled for regular business hours. Understanding the difference can save you money on emergency service fees and help you prioritize repairs effectively.

Reduced Efficiency

If your system is running but not performing optimally, it may not constitute an emergency. However, it’s still important to schedule a service appointment soon to prevent further deterioration and increased energy costs.

Minor Temperature Fluctuations

Slight variations in temperature throughout your home are often not emergencies. These issues can often wait for regular service hours, but should still be addressed to ensure your system is functioning properly.

Regular Maintenance Needs

Routine maintenance tasks, such as filter changes or annual inspections, are important but rarely urgent. These can typically be scheduled during regular business hours.

The Benefits of Professional HVAC Repair

While some homeowners may be tempted to attempt DIY repairs, professional HVAC service offers several advantages.

Expertise and Experience

HVAC technicians undergo extensive training and have experience diagnosing and repairing a wide range of issues. They can quickly identify problems and implement effective solutions, saving you time and potentially preventing further damage.

Safety Considerations

HVAC systems involve complex electrical components and, in some cases, gas lines. Professional technicians have the knowledge and equipment to safely handle these potentially dangerous elements.

Long-Term Cost Savings

While professional repairs may seem costly upfront, they can save money in the long run by preventing more extensive damage and improving system efficiency. Properly maintained HVAC systems also tend to have longer lifespans, delaying the need for expensive replacements.

Choosing the Right HVAC Professional

When searching for an “hvac repairman near me,” it’s important to choose a reputable professional. Look for licensed and insured technicians with positive customer reviews. Many reputable HVAC companies offer 24/7 emergency services for truly urgent situations.

Questions to Ask

Before hiring an HVAC professional, ask about their experience, certifications, and warranty policies. Inquire about their emergency service rates and response times to ensure they can meet your needs in urgent situations.

Preparing for the Service Call

To make the most of your HVAC service call, prepare by documenting the issues you’ve noticed, including any unusual sounds or smells. Clear the area around your HVAC unit to provide easy access for the technician.

Preventing Future HVAC Emergencies

Regular maintenance is key to preventing many HVAC emergencies. Schedule annual inspections and tune-ups to catch potential issues before they become serious problems. Change your air filters regularly and keep the area around your outdoor unit clear of debris.

Energy Efficiency Tips

Implementing energy-efficient practices can reduce strain on your HVAC system and lower the risk of breakdowns. Use programmable thermostats, seal air leaks, and ensure proper insulation to optimize your system’s performance.

Final Thoughts

While not all HVAC issues require immediate attention, it’s crucial to address problems promptly to maintain a comfortable and safe home environment. Understanding the urgency of different HVAC problems can help you make informed decisions about when to call for emergency repairs. By prioritizing regular maintenance and addressing minor issues promptly, you can often avoid major emergencies and extend the life of your HVAC system. When in doubt, consulting with a professional HVAC technician can provide peace of mind and ensure your home’s heating and cooling needs are met efficiently and safely.