Looking for an AARP Medicare plan? What students should know

AARP is an organization or a sector which is providing help to folks by analyzing the needs of people currently living in America and are above age 65. It serves them with zeal and confronts their issues so that they can live a happy life with their beloved ones.

AARP gives a Medicare Supplement insurance plan and it is provided by the United health care insurance company. It is for those people who have made the experience in Medicare services and are worried that their Medicare plans are not enough to meet their needs and requirements of the health insurance coverage. Through this procedure, people can supplement their Medicare coverage. It has been 50 years where AARP Medicare Supplement is proving beneficial for experts who have gotten membership of an organization.

Coverage Plans of AARP Medicare Supplements

AARP provide coverage plans to the people who live in the U.S at any place and can go to those doctors who are familiar or can accept Medicare. For AARP no referrals are required or considered essential. There is an opportunity where people can keep their personal doctor for current checkups. AARP goes long even after the health problems of ones just because he has been paying his premium. He will never get cancellation until and unless he/she stops paying his premium. Medicare costs can be controlled by merging AARP plans with the Medicare Plan D.

The significance of the AARP plan

Sometimes Medicare is not enough to pay out expenditures of co-pays, coinsurances and deductibles then at this situation AARP proves a life saver. All insurance needs can be fulfilled by AARP plans but for this, you have to go through a cumbersome or lengthy enrolment procedure. Before getting enrolment to be a member of AARP by filling the online application form available on the website.

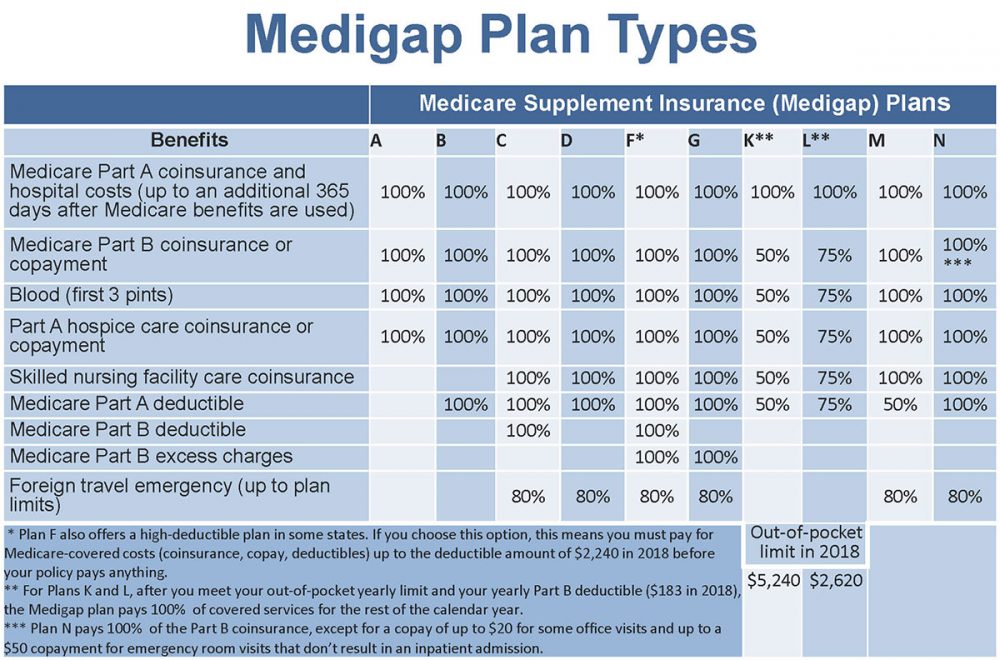

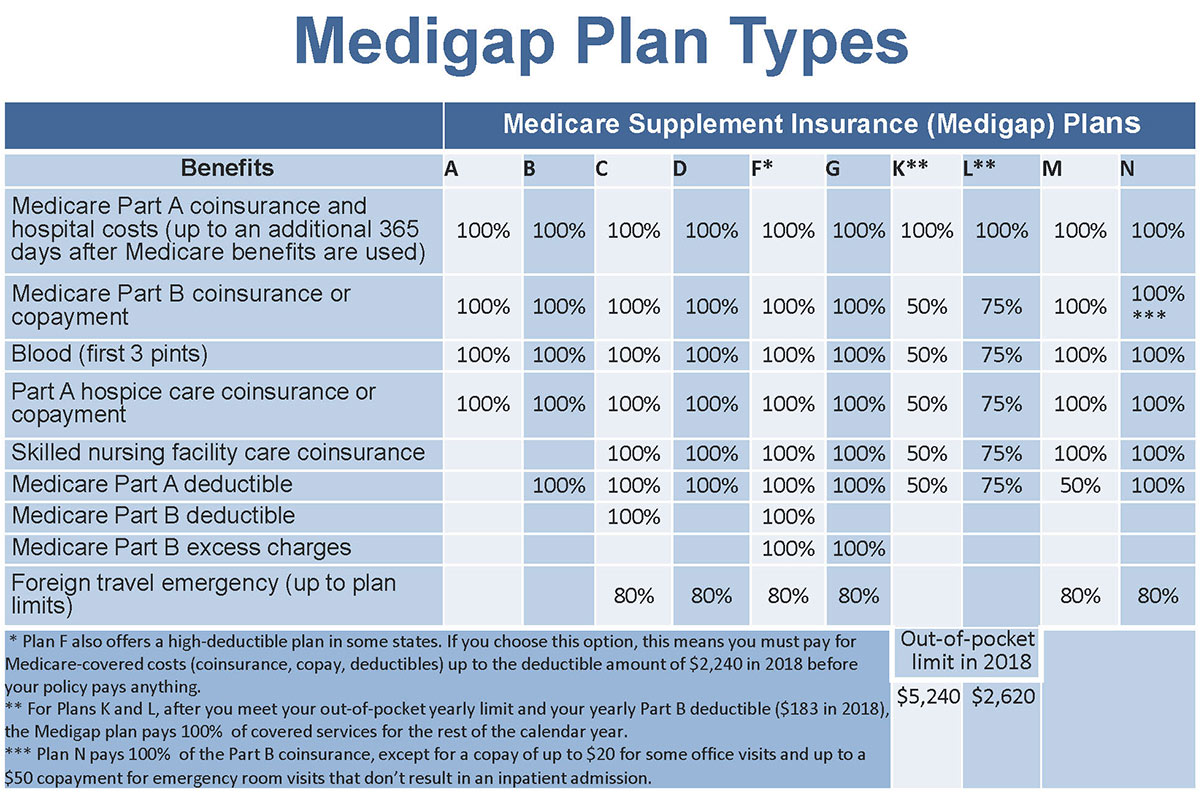

Why AARP Medicare insurance plan?

United Health care is a center who is working in the Health insurance field for about 30 years and is committed to facilitating people with all expertise so that they can make good decisions in the future. These plans fall under the category of Medicare supplement insurance plans and labeled as AARP plans. That’s why it is considered to be discussed in Medigap. A large variety of budgets available where everyone can accommodate a plan to fulfill their needs. It has been seen that people who had done the survey of Medicare plans would suggest AARP plans to be adapted to their relatives, friends, and family.