4 Things to Keep in Mind Before Considering an Annuity

If you are worried about your income after retirement and are not sure what kind of investments to make, you might be considering an annuity and if it could be right for you. However, there are many things to know about annuities before you decide to get one and you should ensure you know all the facts and details before making an investment. Contacting a company like AnnuityAdvantage can be a great first step.

This guide will cover how annuities work and everything you need to know about them before you choose to make the investment or not.

What is An Annuity?

Before making an investment of any kind, you want to ensure you know what it is and how it works.

Annuities can be complicated especially when you start talking about all the different kinds there are and what exactly they all mean in terms of investing and income.

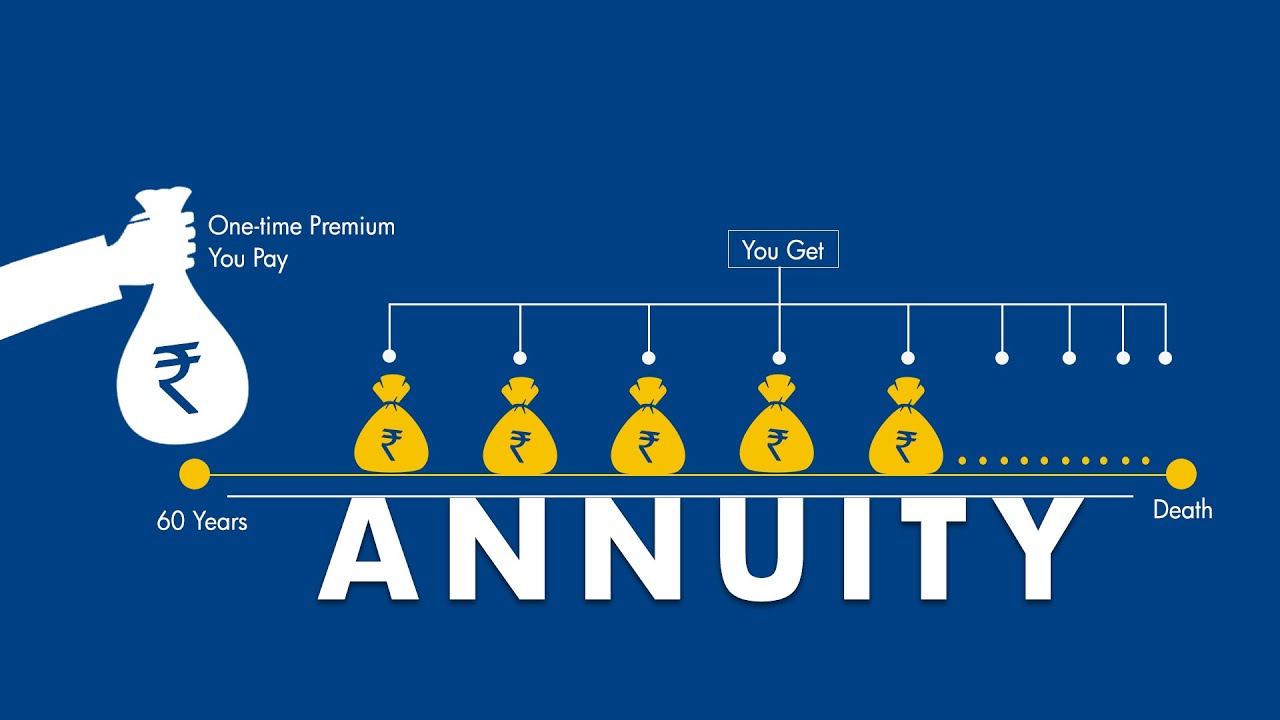

All annuities are insurance contracts though. This means that you will get future income payments in exchange for the lump sum of money you paid upfront. The company that you have invested with determines what your monthly payments will be depending on the original sum you give and how long you want the payments to continue.

Types of Annuities

While looking for the perfect annuity to buy, you might be wondering which type you should get. This is one of the most commonly asked questions because there are many different kinds of annuities and you want to make sure you get the one that makes the most financial sense for yourself and your retirement accounts.

Here are the three main types of annuities and whether they might be the best choice for you or not:

- Fixed annuity. This is when the insurance company that you are purchasing from guarantees that you will earn a specific amount of money every month and it will be paid out over a fixed period of time.

- Variable annuity. This annuity depends on the current performance of the market so it’s subject to fluctuation which makes it a little riskier compared to other kinds of annuities. The amount you receive from this annuity will also depend on how the investments of the insurance company are performing. Since you are part of the stock market, you also have to pay applicable fees which can be anywhere from 2% to 4 % depending on the company and the annuity terms.

- Fixed index annuity. This one is a mix of the two annuities above and is a good option for most people. The principal amount you invest is always protected so you never have to worry about having a total market loss. However, you might get a lower annual return depending on the market conditions and how much you invested in the first place.

Which Annuity Should I Invest in?

There is really no right answer to this question which makes it hard for us to recommend to you exactly which one you should get. One of the best things you can do is meet with a financial advisor as they can tell you what annuity might be best based on your financial situation and the kind of returns you want to get.

Each type of annuity has its own advantages and disadvantages which is why we can’t necessarily recommend one to you over the other without knowing your exact situation.

Keep in mind all annuities have an upside though and that is they allow you to put away cash for the future and retirement without a big tax bill.

Things to Consider Before Buying an Annuity

Now that you know what an annuity is and the different types that are offered, here are the things to consider before investing as well as questions to ask before making your investment.

How Can I Access My Money?

When you make a lump sum and invest it into an annuity, you will get it back through regular monthly payments. Depending on the annuity and the plan you have chosen, you will get these payments throughout a set date or you will get the payments until you pass away.

The option above is the best one if you are older and soon retiring because it ensures you will get the money back in monthly installments.

However, if you are young and think you might need the money before you retire, it’s better to get an annuity that allows you to take out the principal amount with minimal fees just in case you need it.

How Much to Put Into an Annuity

This depends on your current financial situation. Most financial advisors will tell you to put away as much money as you can because the more money you put in, the more you can get out later.

Fees Charged With Annuities

Annuities come with fees just like any other investment. The good thing is that with most annuities, you can pick and choose what fees you want based on the qualities you want your annuity to have.

This means you are only paying fees for the guarantees that you want and that you will actually use.

Look at the Annuity Provider

The annuity you buy is only as good as the insurance company selling it. This is why you want to ensure you research all companies and annuity providers before investing in anything. If you can’t find information about the annuity provider or they have bad reviews online, you might want to consider holding off and looking to get another annuity instead.

Make sure the annuity company has high grades with credit rating agencies including the major ones like AM Best, Moody’s, and Fitch.

The Bottom Line

Annuities might seem complicated but they are pretty straightforward once you know the basic details and what kind you want to invest in. By using this guide, you will be sure to ask all the right questions and ensure that you are getting the right annuity for your age and current financial situation.